PDFelement - Edit, Annotate, Fill and Sign PDF Documents

Submitting the tax return is an obligation for any citizen. There are various tax calculation software and online tools available for filling any tax related form. It becomes very difficult to make a choice of which software to use that totally applies to your financial situation. Now to make it easier, people use the electronic mode of filing tax related forms because it can speed up the process of tax form submission. Most of the major forms can be filled using these software. This article will compare some of the best taxes software by providing their key features, merits and demerits in the tax software list.

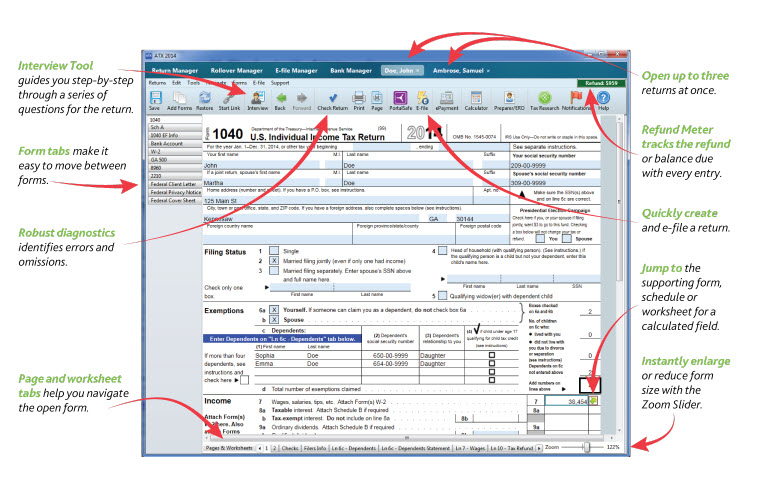

The ATX is a tax software which delivers continuous product enhancements to deal with the changing tax laws. It provides access to self-help tools that are available 24 hours to provide online Solution particularly during the busiest time of year which makes it one of the best taxes software.

Pros:

Cons:

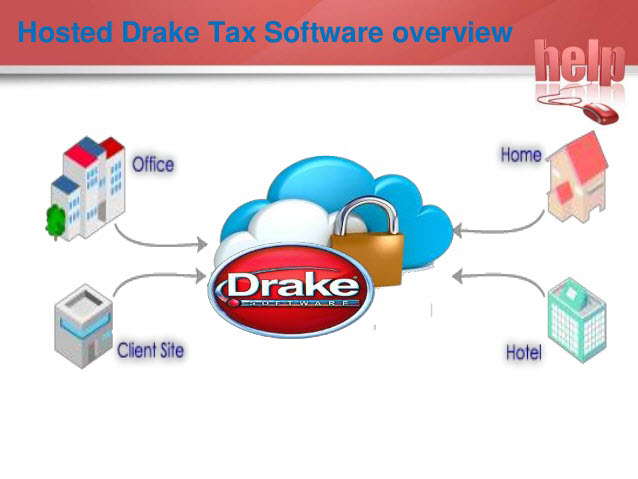

Drake software is one of the best taxes software solution intended for quick data entry and return processing. This e-filing system includes built-in free modules like write-up, payroll and training services. The price of this software is $300 for 15 returns with only tax functions are provided with this package. The online support provided by this software may include some charges for providing some suggestions to the users.

Pros:

Cons:

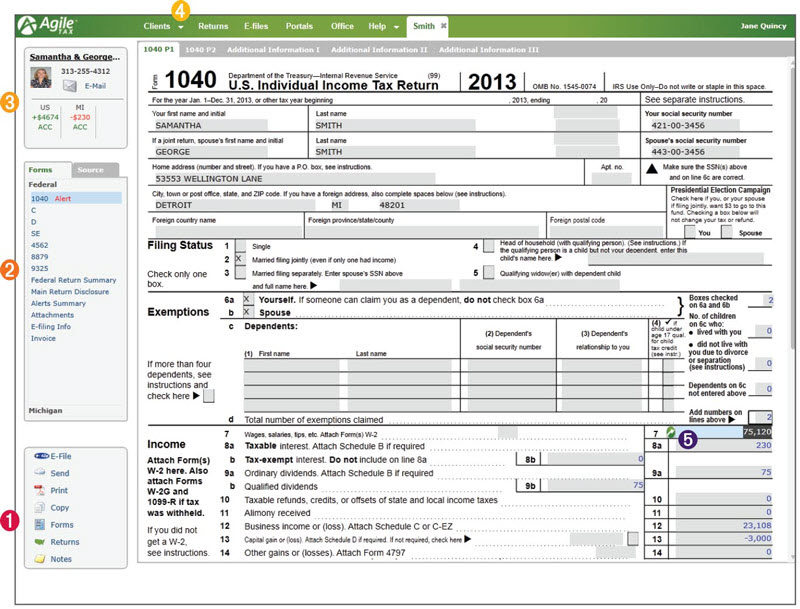

Agile Tax is a tax software which is in its second year as a tax solution. The system is designed for high volume tax processing and intended as a standalone product. The software was built as an online solution, and the tax professionals can develop a numerous returns for a fixed cost per month. Agile Tax also has an internet based solution and it can be used through any browser currently supporting the Microsoft Silverlight technology.

Pros:

Cons:

ProSeries Tax is the tax software solution developed by intuit. It is designed as an affordable tax software solution to assist tax practitioners with processing returns quickly. ProSeries Professional is intended for accounting practices which focuses on high volume and a wide variety of returns, while ProSeries Basic is designed for beginners for completing simple tax returns.

Pros:

Cons:

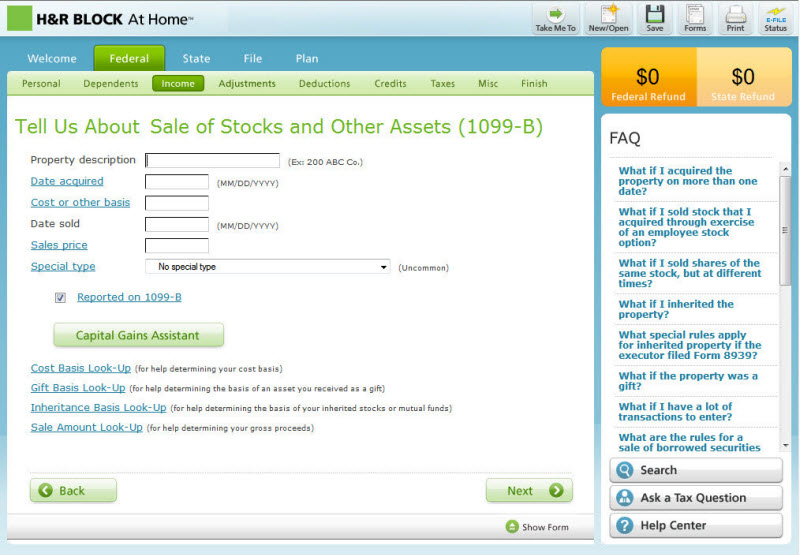

H&R Block provides the best value to the customers who can create a correct tax return at an affordable price. All the tax forms are available to all types of filers but if you pay an added fee you can get additional guidance and instructions. The tax software includes step-by-step guidance within the program as well as free tax advice with one of its personal consultants.

Pros:

Cons:

Still get confused or have more suggestions? Leave your thoughts to Community Center and we will reply within 24 hours.