PDFelement - Edit, Annotate, Fill and Sign PDF Documents

Filling and paying taxes online is now becoming the fastest growing alternative to paper based filings and payments. Across the United States, this system is gaining wide acceptance more than ever. The reason for this is not farfetched. Accuracy, convenience and the ability to deposit your refund directly are some few reasons why online payments are becoming the preferred method. It is important to state that the IRS online payment is safe as your tax return information is encrypted and transmitted over secure lines to ensure that it is confidential and an acknowledgement is issued when your return is issued and accepted.

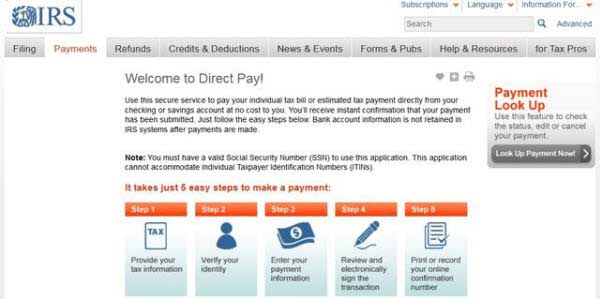

Pay Online Directly from Your Bank Account:For individual tax payers, the direct online payment form bank account offers a free, secure electronic paying method. You can use this option to pay your individual tax bill or your estimated tax payment directly from your savings or checking account without any additional cost to you.The good thing about this system is that on payment, you will receive an instant confirmation message that your payment has been submitted. This is also another way of double checking and confirming your payment and it is also important to note that your bank information will not be retained in the Internal Revenue Service system once you have made the payment providing another layer of security to tax payers.

For this option, you also have a “Look up a Payment “Feature which can allow you view payment details and status. One advantage of this feature is that you can cancel or modify your payment there until 2 days before your payment is due.

Pay with Debit or Credit Card:You can pay taxes online with your debit or credit card. It is easy and fast. The most important thing is to choose an approved payment processor to make your payment. It is critical to note that with this option, you can pay by phone, internet or any mobile device and it does not matter whether you paper file, e-file or even responding to a notice or bill. It is safe and secure. However, note that the Internal Revenue Service uses standard service providers and commercial card network providers.

Be assured that your information will be used solely to process your payment. For example, the IRS will accept Visa, MasterCard, Discover, American Express and some other cards on some of the payment processor. However, it is important to understand that not all IRS tax forms are eligible for payment by debit and credit card and also there are some limits of the frequency you can make individual or business payment.

Step 1: Go to the direct pay page of the IRS. There, you will choose the applicable tax form, and then state the reason for payment and the task year.

Step 2:Go over to the next page to verify your identity. To verify your identity, you are expected to provide the information about your filing status from your last tax return. You will also provide your full names, your social security number, date of birth and your current address. It is important to ensure that there are no forms of discrepancies in the information supplied.

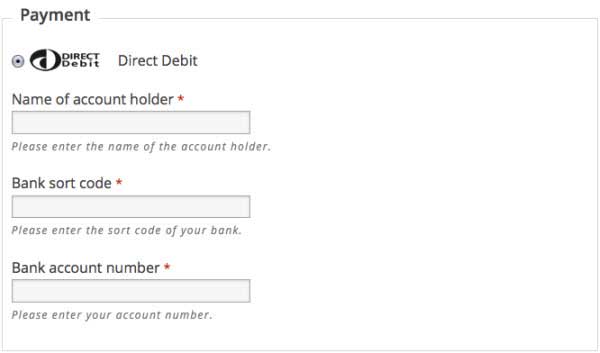

Step 3:Enter your payment information. In this column, you are expected to enter your payment amount. Note that you will be expected to re confirm the amount before it is accepted. Enter the payment date and your bank account information. Your account could be a saving or checking account, note that it does not matter.

Step 4:Review and electronically sign the transaction.

Step 5:You have to record or print your online confirmation number for future references.

Step 1: Go to the IRS website and navigate to the pay your taxes by debit or credit card page.

Step 2: Choose your payment processor. For example, for individual tax payment, you can use pay1040.com .

Step 3:Click on the processor. It takes you to make a payment page.

Step 4:Select your tax form information on the first page. You are expected to enter the tax category, tax form, tax form option, payment option and filing location.

Step 5: Click continue, it takes you to the next page where you enter your tax payer information. This will include your social security number, name and address.

Step 6:Go to the next page, select a payment type. Enter card number, name etc and complete the payment.

Still get confused or have more suggestions? Leave your thoughts to Community Center and we will reply within 24 hours.