PDFelement - Edit, Annotate, Fill and Sign PDF Documents

Filing taxes is a duty of every citizen in the United States. It is a civic obligation. However, due to circumstances beyond ones control, many would not be ready to file their taxes before the deadline of April 15 and this is actually worrisome. In a bid to accommodate and make things a little more flexible, there became a need for an extension. This means that citizens will still have a second chance of filing taxes for the year, however, this must be done officially through the Tax extension form. This article will look at issues surrounding Tax Extension Form.

With the arrival of the spring season, April 15 will be here before we know it. There are chances that many people will not be ready to file their tax return before the deadline. Due to this obvious fact, the Internal Revenue Service granted an automatic six months extension every year to ensure people file their taxes. This is the main purpose of the tax extension form. On completion of the IRS extension form, it allows an individual to officially request for an extension of time to file their tax returns. However, it is important to note that the tax extension form must be received by the IRS by the original filing deadline to be considered valid.

There are many tax extension forms serving different purposes as can be seen below. However, it is important to know which one to use at any given situation and time.

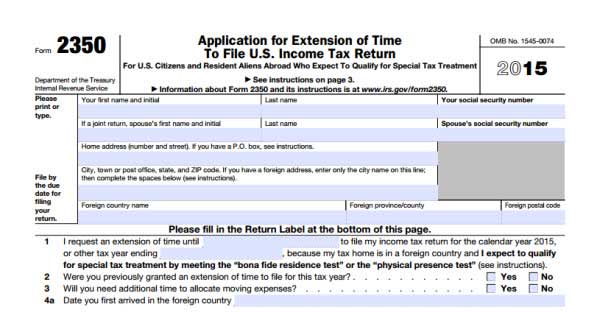

You can only file use the IRS Form 2350 if you are a U.S. Citizens and Resident Aliens Abroad Who Expect To Qualify for Special Tax Treatment or in a situation where your tax home is a foreign country throughout your period of bona fide residence or physical presence whichever applies. Note that the extension given to you if successful will likely be to a date 30 days after the date in which you are expected to meet either the physical presence test or the bona fide residence test.

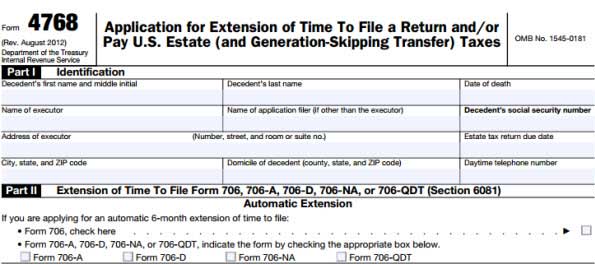

This is only applicable if what you are paying is the U.S Estate taxes as an executor or someone other than the executor.

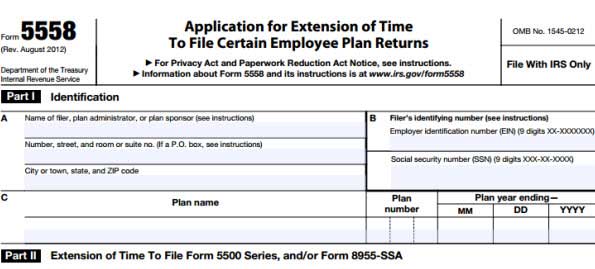

You can only use the Form 5558 to apply for one time extension of time to file the form 5500 series which comprises the Annual report /return of employee benefit plan, Short form annual return/report of small employee benefit plan and the annual return of one participant retirement plan denoted as Form 5500, 5500-SF and 5500-EZ respectively.

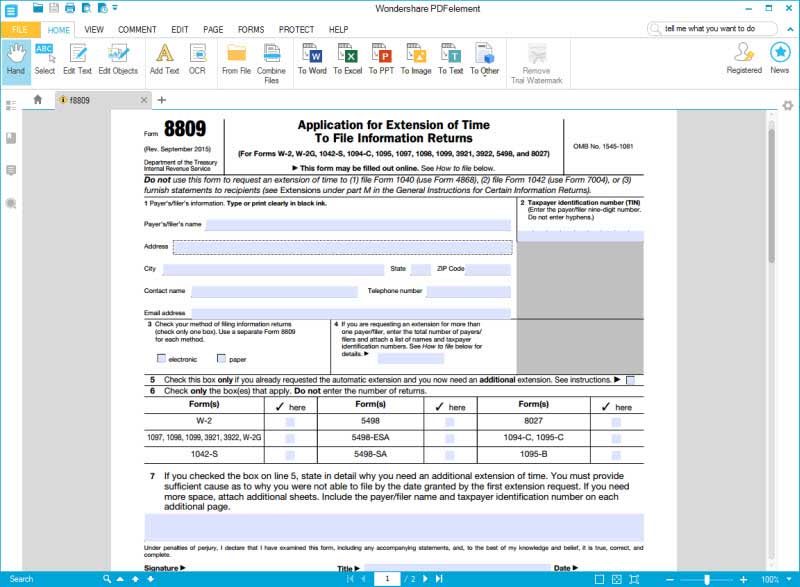

You can only use the Form 8809 to request an additional extension of time to file only the forms shown in line 6 of the current tax year on the form. The forms could be the W-2, 1099, 1097, 5498 etc Once you require more time to file any of these forms, you can apply for an extension using the form 8809.

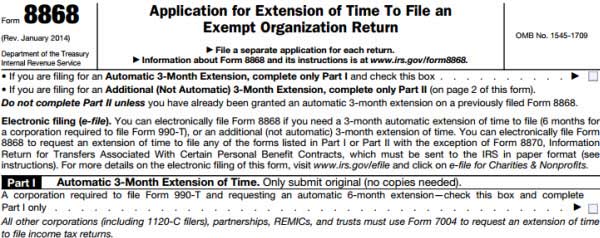

This form is used by an exempt organization to request an automatic three months extension of time to file its return and also apply for an additional three months extension if the original three months extension was not enough time.

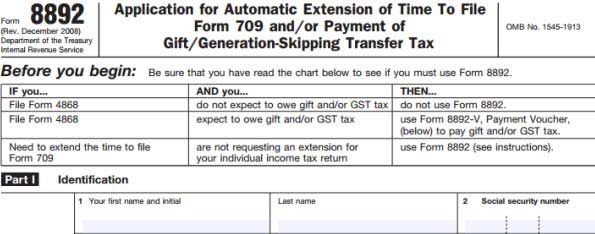

The form 8892 can be used under the following situations. The first is to request an automatic 6 months extension of time to file form 709 if you are not applying for the extension of time to file the form 4868 or it can also be used to make a payment of gift tax when applying for extension of time to file form 709.

This is the proper and required tax form to use to file the extension of your individual income tax return and submit it to the Internal Revenue Service by April 15. Also note that you must also send payment for any due taxes. In addition, tax payers can also file for an online tax extension at appropriate website by electronically filling it. Web programs like the Wondershare PDFelement can help you fill the IRS Form 4868 electronically. You will need to estimate the total payments for the year that you expect to report on your income tax return. You are also expected to estimate your total liability for the year that you expect to report on your tax return.

Still get confused or have more suggestions? Leave your thoughts to Community Center and we will reply within 24 hours.