PDFelement - Edit, Annotate, Fill and Sign PDF Documents

Every April 15 is known as the “Tax day” in the United States of America. This is a day most Americans send in their tax forms as well as money to the Internal Revenue Service with the hope that they may get a refund. However, whether you get a refund or owe some money will be determined by the use of a tax refund calculator to figure out how much you will likely get back. We will look at the top tax refund calculator that will help you figure this out easily.

When you talk about taxes, then there are not many other names you will call before TurboTax TaxCaster. It has been one of the most popular names in taxes for a long time and with an advantage of having a free calculator. That means apart from downloading the apps on Google Play store, you can access it online. The program is a great tax calculator tool because it even allows you to include other sources of income beside your primary source as well as put into consideration, retirement, education and charitable donations when doing a final estimate.

Pros:

Cons:

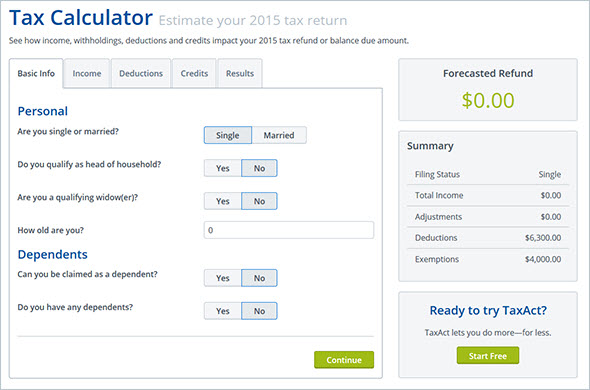

The TaxAct TaxCalculator is a simple and easy to use online tax calculator which will help you calculate how much tax refund you are expected to get or how much you will owe. When using this tool, you will have the option of factoring in income, deductions, tax credits which could include education and energy savings in order to get a final estimate. TaxAct also factors in some personal information to determine your calculation. For example, you will have to tell the program if you are singe, married, head of household or a qualifying widow etc.

Pros:

Cons:

The esmartPaycheck is an easy to use pay roll management software that can automatically calculate state and federal payroll taxes for employees and employer among other functions. Anybody can simply access the tax calculator at their website and start using it with hassles. Although it is a free calculator, it requires you to register and create your username before you can calculate your tax refund. esmartPaycheck is a well designed, simple to use tax refund calculator which will allow you to enter income information while including exemptions and hourly rates. With this software, you are just few clicks away from knowing how much refund you can get or how much you owe in taxes.

Pros:

Cons:

The Tax Estimator is a program of Taxbrain calculator which can help you determine how much you are getting back from the Internal Revenue Service. In just a few more steps compared to the other tax refund calculators, the Taxbrain tax calculator will calculate how much you have as tax refund or how much you owe the Internal Revenue Service of the Federal Government. When compared to other tax calculator, the tax brain calculator is more in depth incorporating specific questions and scenarios to determine the final amount due for an individual.

Pros:

Cons:

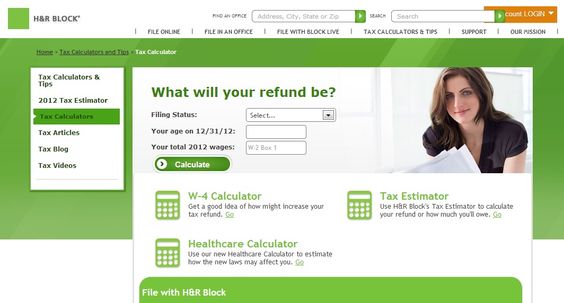

The H&R Block Tax Estimator is one of the biggest names in Tax calculation services. It allows any user to use its free calculator to calculate the amount the Internal Revenue Service will refund you or how much you owe the Government. Whatever the case, the H&R Block will utilize the basic information you provide about your income and expenses to help you calculate the status of your tax refund. It is very simple and easy to use. You do not need any advance knowledge to use it. All you need is to log on to the web site and enter your details. You will get the required result.

Pros:

Cons:

The tax refund calculators listed above have simplified tax calculations, making it easy for anybody to know his or her tax status in just a matter of few clicks. Whether you get a refund or owe the government, you can use any calculator listed above to verify.

Still get confused or have more suggestions? Leave your thoughts to Community Center and we will reply within 24 hours.