PDFelement - Edit, Annotate, Fill and Sign PDF Documents

Tax filing is a necessary duty of any citizen and you can do it by using various software and online tools. The procedure of filing tax has changed itself from writing in hand to filling electronically, because filing tax online can speed up the process of tax return submission. The article will compare some online tax filing software by listing their key features, advantages and disadvantages.

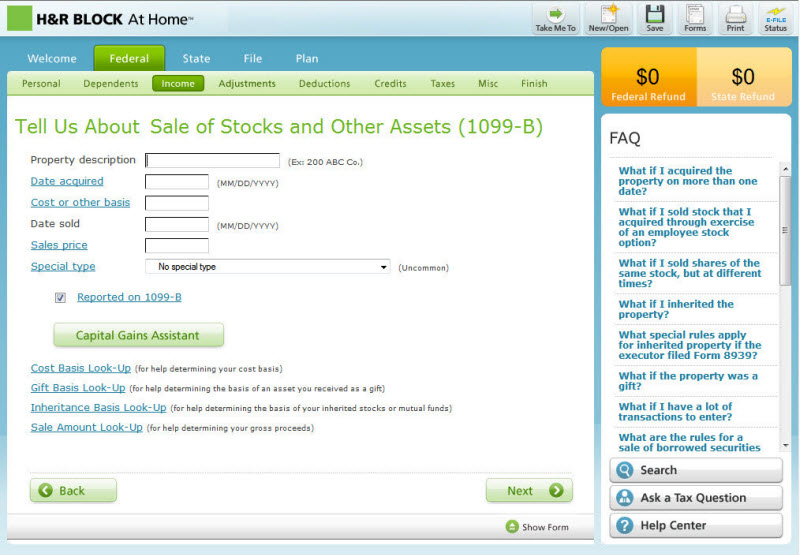

H&R Block is one of the most used online tax filing software. It has many users who are homeowners and investors. This online tax filing software can be used to start filing tax for free with limited services. It is a paid program which starts at basic service of $24.99 to file tax online. It has many versions designed for different categories of users. The free online tool is usually used to show the efficiency of this online program to the first time tax fillers. It has a mobile application to further ease the process of tax filing and also the website has a community where the users can ask for help related to tax filing. It is designed for low income individual to high income individual or organizations.

Pros:

Cons:

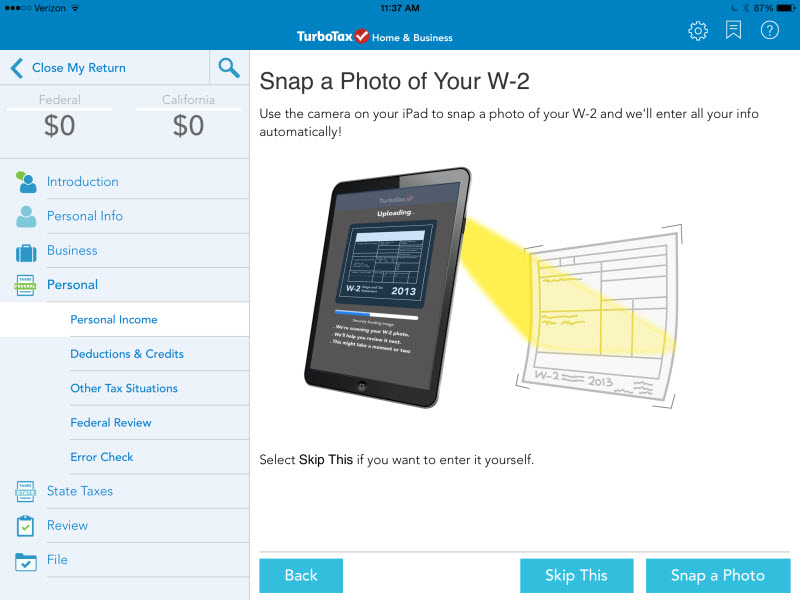

Turbotax is one of the most recognized online tax filing software. It can be used for free by first time tax filler. To avail all the features, this online software must be purchased; the price of the basic version is $34.99. The name of the basic version is called deluxe and there are two other versions for advanced user named Premier and Home and Business. The online tools guarantee for maximum tax refund with an assurance to double check your return. This online tool can also assist you with a mobile application to calculate certain elements on the go.

Pros:

Cons:

Intuit is an online tax filing software which can help you to file your tax easily and effectively to file tax online. The lowest price category of this software is $10.95 for 300+ returns for individuals. This website is packed with many individual tools to show the calculations and instructions to follow while filing the tax return. It has feature to chat with specialist on tax filing.

Pros:

Cons:

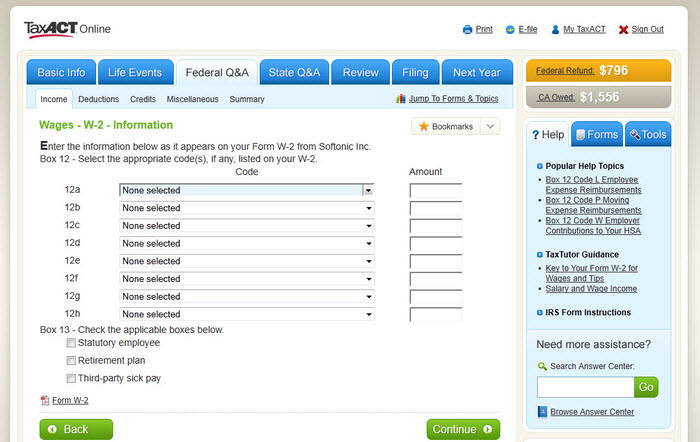

Taxact is an online tax filing software to calculate your tax which allows you to complete your tax return in a simple manner. The online tool offers a free trial for the first time users which is ideal to fill up simple tax returns. It gives access to more than 300 tax deductions. The paid version of this starts at 9.99$ called the basic version. It provides step by step guidance and unlimited phone support to the users to fill up your tax file. It has a mobile application called the Taxact express which is available in all major mobile operating system. Additionally, it provides email help to its users when ever required.

Pros:

Cons:

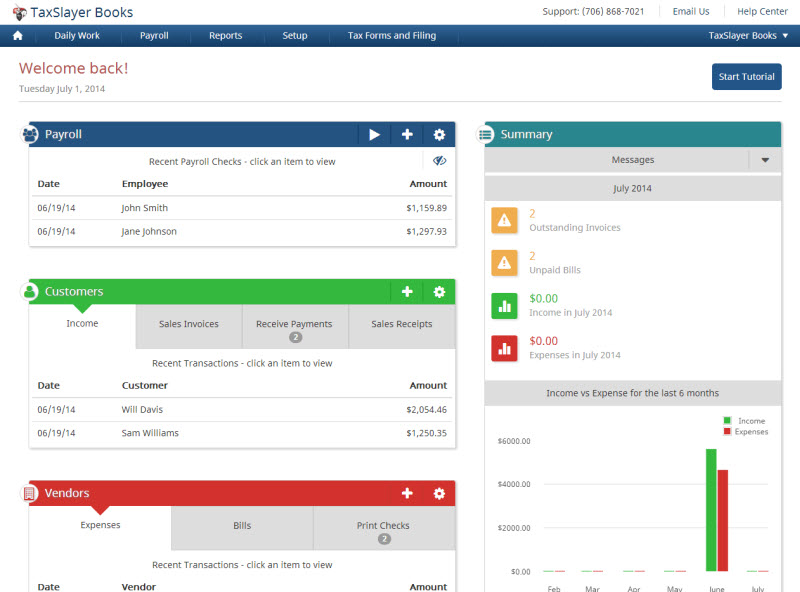

TaxSlayer is an online tool that can help you prepare different types of federal income tax returns. This program offers different versions of its program to different types of needs of the users to file tax online. The basic version has been tailored to create the 1040 return. It provides guidance in every page asking various questions to the user. The users can use an also use additional mobile tools to further enhance the saving in tax. The website guarantees for privacy and security regarding your financials. They also provide an option to deduct their tax filing fees directly from your federal tax fund. It starts at a price of $12.99 which is meant for individuals who are employed or have a small business.

Pros:

Cons:

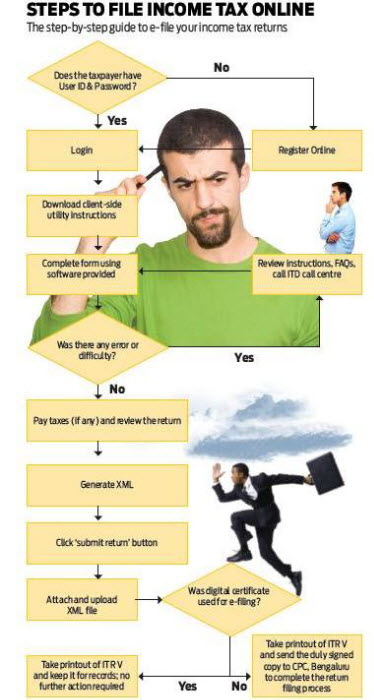

Filing tax is not a tough task, you can easily do it by following a few instructions. The step by step guidance is given below will show you how to file tax online, by following these steps you can file your tax yourself.

Step 1: First of all search for online tax filing programs. Go to the website you selected for tax filing. You have to purchase a package or you can use it for free if you are fling tax for the first time.

Step 2: As soon as you enter into the process you have to enter your name and other details about your income source. Enter the details and move on to the next step.

Step 3: Here, you have to enter your employer identification number and you will get basic details on how to file tax online. After that you have to fill in your personal information in detail. You have to enter your federal wage information and much other related information.

Step 4: After that you have to select many different options that apply to you on the basis on the information asked. After finishing it you have to enter the details of all sources of your income with the amounts.

Step 5:For the next steps the online tool itself will provide assistance to you in completion of your tax return. After finishing the tax return you can review and double check. Final you will get the amount of your tax refund.

Still get confused or have more suggestions? Leave your thoughts to Community Center and we will reply within 24 hours.