PDFelement - Edit, Annotate, Fill and Sign PDF Documents

Estimating your tax return is a very important exercise for taxpayers in the United States. As a tax payer, you will need to know if you have over paid your taxes to the government and need a refund or if you have under paid and owe the government. This is the actual importance of a tax calculator. It helps you determine your status by doing the calculations with the information you provide. There are many online and offline tax calculators available for use. However, this article is going to look at the free online tax calculators to help you accurately estimate your tax return.

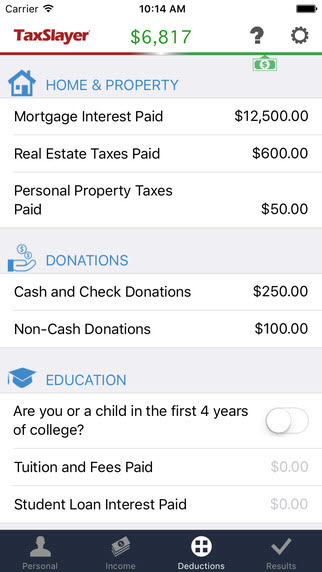

The Tax Slayer free tax calculator can be accessed when you go to online. You can use it to estimate your task refund very easily with just few steps. It will require you to enter certain basic information like your age as at 31st December, marital status, filing status and a whole lot of questions bothering on your eligibility. After providing the basic information, it will require you to also provide information on family, income, deductions and credits. The essence of this information is to enable TaxSlayer compute your tax refund correctly. When the calculations is complete, you can see the estimation at the top right of the online page and you can print afterwards. It is simple and easy to use. You do not require any sophisticated computer knowledge to use it. All you need do is to supply necessary information and click buttons.

Pros:

Cons:

If you have withheld enough tax in the past year and will like to determine whether you still owe the Internal revenue Service or you are qualified for a tax refund, then use Calcxml to estimate your task standings. The Calcxml online tax calculator is simple and easy to use. You will be expected to supply your income and task information like the tax filing status, gross annual income, number of dependent children, number of personnel exemptions among others. When the information is supplied, all you need to is to click on the submit button and your tax return estimate will be calculated and shown.

Pros:

Cons:

TaxToday is a free online tax calculator which will help you estimate how big your refund will be or how much you owe the government. It is an up to date tax calculator which applies to the last financial year that has ended. That means you can be able to file for your current tax return that is due. However, it is important to note that TaxToday calculations are just an estimate like some other online tax refund calculators but has some high level of accuracy because it calculates the same way as the ATO works out your refund. TaxToday tax calculator will request for some information like the gross employment income, fringe benefits and others.

Pros:

Cons:

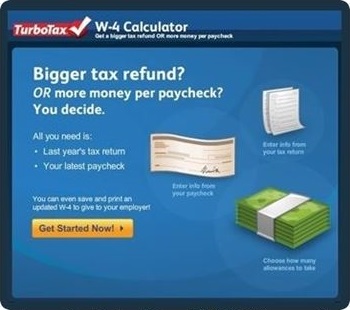

This online calculator is a user friendly tax refund calculator. No wonder it is one of the most popular tool among tax payers. Estimating your tax returns with TurboTax is not complex. All that is required is to supply some basic information and the TurboTax online calculator calculates and gives you the estimate. The program is a good tax calculator tool because it even allows you to include other sources of income apart from your primary source as well as put into consideration, retirement, education and charitable donations when doing a final estimate.

Pros:

Cons:

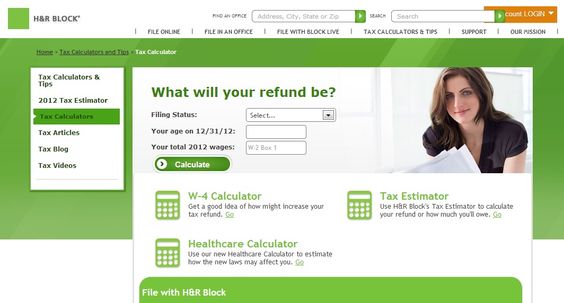

The H&R Block has been in existence since 1955 helping a whole lot of Americans with their taxes although they started off with offering high interest loans based on estimated tax refund. However, they have now become a household name in tax refund calculations. What you need to do is to visit their website and use their tax refund calculator. It is important to note that the H&R Block online calculator is equipped with the latest Internal Revenue Service figures making it up to date for tax refund estimations.

Pros:

Cons:

Still get confused or have more suggestions? Leave your thoughts to Community Center and we will reply within 24 hours.