PDFelement - Edit, Annotate, Fill and Sign PDF Documents

Every year taxpayers are expected to file their taxes return to the Internal Revenue Service. While there are paid tax preparatory software that people use for this task, there are also free tax software which are good enough to completely file your taxes and save you money during tax filing seasons. This article will look at the top free tax preparation software you can use for this tax season.

There is a whole lot of free tax software in the market. However, only the free best tax software partner with the IRS to bring free tax preparation to taxpayers each year. The following are the best 5 tax software you can trust.

The rating of tax software is its ability to offer intuitive simplicity and this is what the TurboTax is known for. The TurboTax is one of the best free tax software that offers streamlined tax preparation and also boast of an easy to use interface. One benefit it offers to its teeming users is that it offers step by step instructions which are easy to understand that are very useful to first time filers prepare their taxes with relative ease.

The TurboTax software will prompt you with key question when you are in the process of filing your taxes to help capture any changes that could affect your taxes. In addition, there is real time live audit risk detection and you also have the opportunity to get a free live advice from the experts to help clear some minor or major issues you do not understand. TurboTax now possess new feature like SmartLock where users can get their live tax prep questions using a one way video technology. This and other features have made TurboTax as one of the best free tax software.

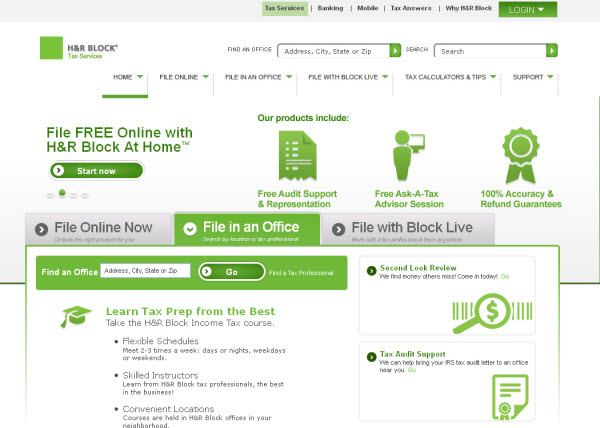

The H&R Block is one of the most popular names in the tax scene. In fact, it is not new to taxpayers. The H&R Block get its major rating in the area of customer service. There is no doubt that filing your own tax can be overwhelming. However, the H&R Block comes in to make things easier and simpler by offering support through phone and email and the good thing is that it is just free.

Also, with the H&R Block, you have the option of going for a face to face consultation at the branch locations of the company scattered around the country. The H&R Block also offers tax preparation of other tax form other than the basic 1040 tax form for free. In addition, the H&R Block will offer free in audit support if you return gets flagged for an audit. Like the TurboTax, the H&R Block is also very valuable for first time tax filers and it’s rightly judged as one of the best free tax software for taxpayers.

The eSmart tax is owned by Liberty tax and has been waxing strong from year to year. It is one of the best free tax preparatory software available with the potential of generating good savings for you during tax return filing. The free eSmart version can help you e-file your tax return for free as well as other products. The eSmart tax software also does well in providing adequate customer support for users through live chats.

Liberty Tax CPA is always on ground to provide free audit support. One very good feature of using eSmart tax is that it is possible to import your previous year tax return from other tax preparation providers like the H&R Block and the TurboTax and the good thing is that it is free. With this, you can easily look at previous tax returns even if you did not use the eSmart tax software in those years and make comparison with your present situation if necessary.

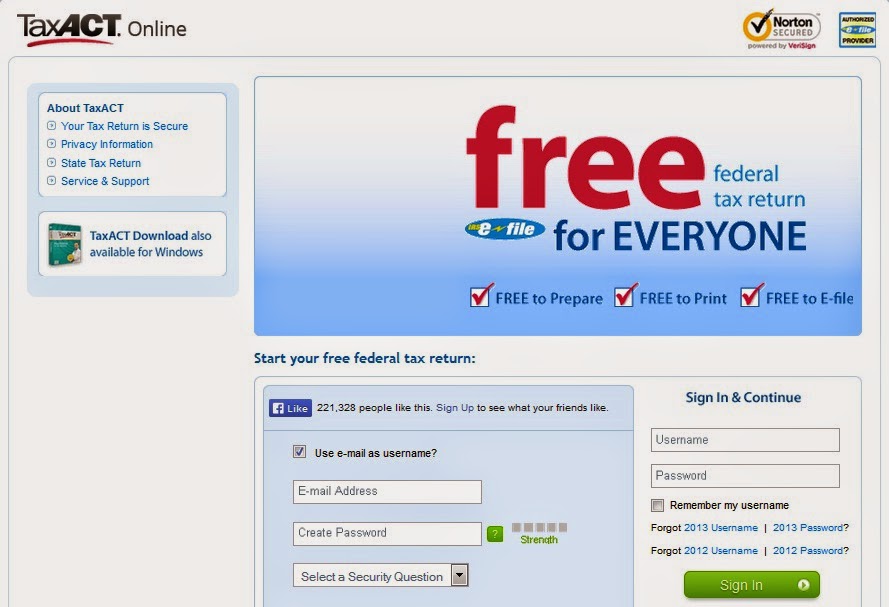

This is one of the best free best tax software for taxpayers although it does not match the advancements on offer at H&R Block and TurboTax. However, TaxAct covers all basic requirements for successful tax filing. It does well in customer service by offering tax guides, free email support and other resources to make things easier for users and help them file their taxes without complications.

The advantage TaxAct has over most of its competitors is that even if you do not want the free version, you can get the paid version relatively cheaper than others without the quality compromised. Like the H&R Block, the TaxAct free version only applies to federal returns. That means it is not free for state filers. However, it can just handle any tax situation and it is not limited to first time filers or simple returns.

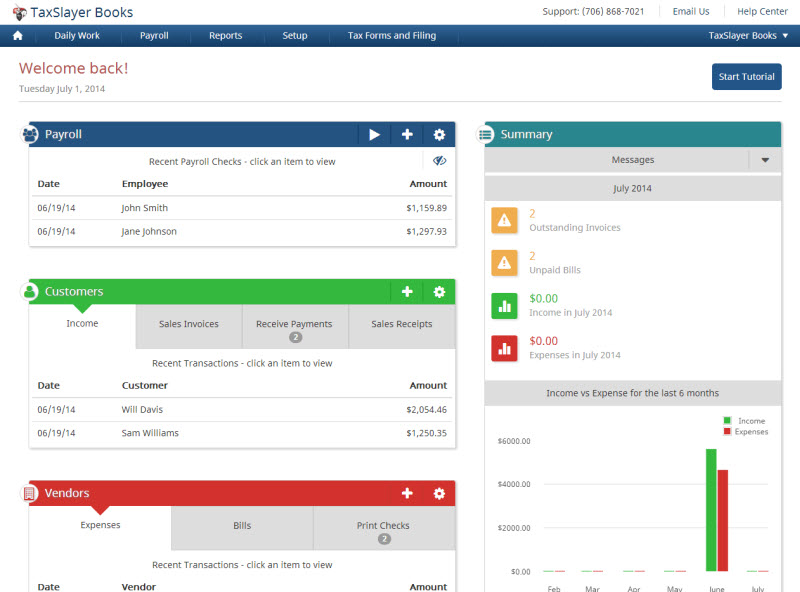

TaxSlayer Free Basic stands as an alternative to the first four free tax software listed above. Like other mentioned above, it offers step by step instructions and easy to use guides which is particularly useful for tax newbie. In terms of customer service, the TaxAct offer phone and free email support to users.

TaxSlayer free edition like its counterparts supports the basic tax forms like the 1040, 1040A and also the 1040EZ tax returns. However, the only disadvantage of this software is that it lacks audit detection or assistance which could be very important in a fiscal year.

Still get confused or have more suggestions? Leave your thoughts to Community Center and we will reply within 24 hours.