PDFelement - Edit, Annotate, Fill and Sign PDF Documents

In order to avoid finding yourself on the wrong side of the law and to avoid penalties and interest, it is important to pay what you owe to the government by the due date following the right procedures. The Internal Revenue Service provides several tax payment options for tax payers. Some may be convenient while others may not. However, it is important to know and understand what options you have as a tax payer in order to pay your IRS tax payment as at when due. This article is going to look at several IRS tax payment options while offering some tips on choosing them.

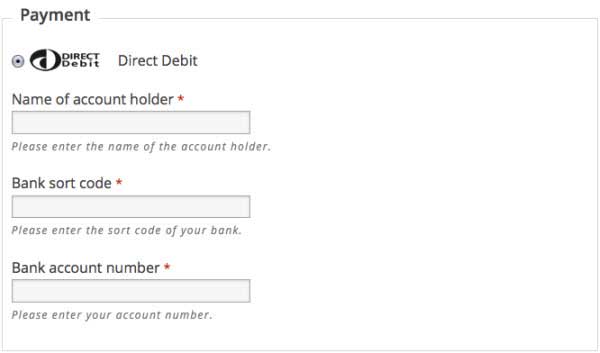

Direct Debit Payment Option : One of the easiest ways of making your federal tax payment is by using the “Direct Pay” on the IRS.gov website. With this option, you are allowed to pay your taxes directly from your savings or checking account.

However, it is important to note that you will need to provide your social security number or your individual tax identification number in order to use the system. The website will ask you the reason for your payment and it is important to select “Tax Return” so that your payment will be applied from the amount owed from your tax return.

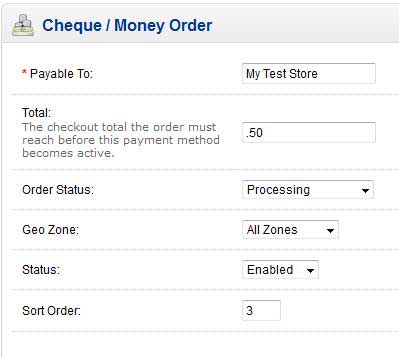

Check or Money Order Payment Option : This option is useful for people who are filing a paper return. Using this option, you are expected to use the payment Voucher IRS Form 1040-V to submit your payment. You can then mail the form and the tax return in the same envelope to the IRS. To learn the mailing address, read more here.

Credit Card Payment Option: There are some times when you may not have enough fund in the bank but do have some credit in your card, and then you can use the credit card to pay your taxes. All that is required is to go to the IRS website and select a payment processor.

However, note that there is a processing fee in using your credit card for IRS tax payment but it is better than the penalties for paying late.

Installment Payment Plan Option:This option is mostly ideal when your tax bill is too high for a credit card. Then at this point, the IRS will accept a monthly payment from you. In fact, you have an option of picking the monthly payment amount and the date it will be due.

Note that the IRS can grant you an installment payment option request irrespective of having enough money on hand to pay once if you have previously filed and paid your taxes on time and your tax amount is $10,000 or even less. Also note that tax payers in bad financial state can use the installment payment option to make partial payment of their taxes. To set up Installment Payment Plan, taxpayer needs to complete the Form 9465 .

Offer to Settle Option:This is a good option is paying your taxes will cause you extraordinary hardship. In this case, you can use the “Offer in Compromise” which is a settlement offer to the IRS. The whole thing is about offering to pay a part of your taxes immediately while the IRS drops the rest.

However, you need to qualify for this by filling a lot of paper work and demonstrating that it is impossible to pay all the taxes you owe. But note that if it is possible for you to pay your taxes through an installment plan, then your offer in “compromise” will not be approved.

Still get confused or have more suggestions? Leave your thoughts to Community Center and we will reply within 24 hours.