PDFelement - Edit, Annotate, Fill and Sign PDF Documents

The thought of filing your taxes can be overwhelming for a newbie who intends to prepare and fill it themselves. The key to simplifying this process is your organization. Whichever way, you decide to use, you will need to obtain the necessary information required before you begin the process and this include your interest payment, property taxes, school taxes, receipts, and other applicable information along with your prior tax year return. Once you get organized and prepared, filing taxes will become easier even as a newbie.

Everyone is required to file tax return if their income is above some certain level which certainly varies depending on the filing status, type of income and age of the individual.

There may even be some time when you may want to file a tax return even though you are not required to. This is because there are some added advantages of filing your taxes.

The following are some reasons for which you should file your tax.

There are 3 tax filing options ( E-options) which is used to file taxes for individuals and are explained below.

The Free File is an IRS Electronic option where you use IRS free file or Fillable forms. However, you can only use IRS free file if your adjusted gross income is $62,000 or less. These free file software makes taxes easier and state the returns available in such a way that it is clear to the tax payer. For income above $62,000 then a fee file fillable form can be used.

However, note that in the free file fillable option, it is important you understand how to do your taxes yourself because it offers only guidance and state prep is not available. Note that after you select the free file software, you must also select “Leave IRS site” in order to get to the tax software website.

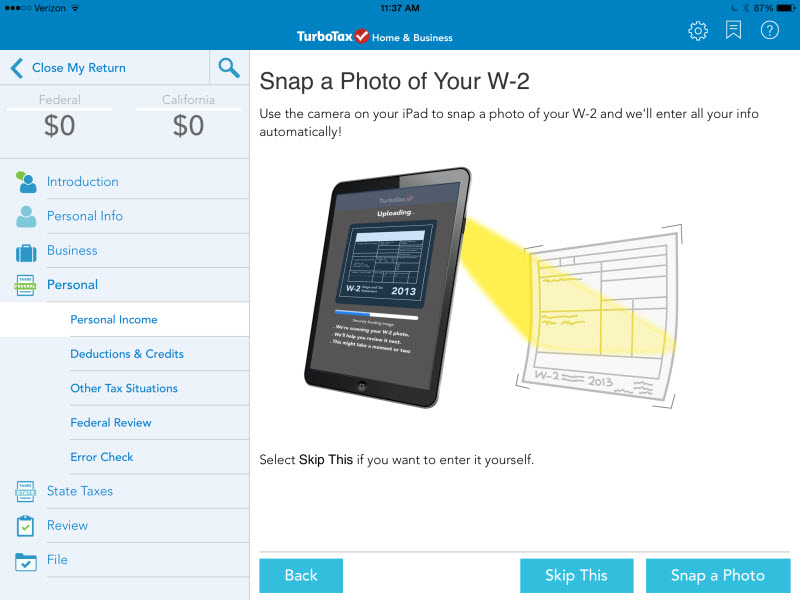

Another option to file your taxes is through the use of commercial software. This commercial tax prep software helps to prepare and file your taxes and it is transmitted through IRS approved electronic channel. The software uses a question and answer format which makes tax easier. Therefore, you must gather your information before getting the software. One good advantage of this method is that when you file your return, it will be securely transmitted through an IRS electronic transmitted channel and not by emails because they are not secure. With this, the IRS computer will scan your return for mistake and return it back to you where you can fix it and send it right back. This will save your time and prevents delay due to simple mistakes.

Tax Pros Authorized by IRS is an e-file provider, qualified to prepare, transmit and process e-file returns. Note that to make things easier for you, IRS has provided an online database of all e-file providers authorized by IRS.

Now you have the choice of locating the Authorized IRS e-file provider nearest to you where you can now file your tax return electronically. However, you must conduct your due diligence when choosing an e-file provider.

Still get confused or have more suggestions? Leave your thoughts to Community Center and we will reply within 24 hours.