PDFelement - Edit, Annotate, Fill and Sign PDF Documents

Knowing the task bracket you fall into will help you know you figure out how much money you are expected to pay in taxes each year. It can also go a long way in helping you determining your tax liability for some unexpected income, investment income or even retirement planning. The essence of this article is to look at how you can know your tax bracket.

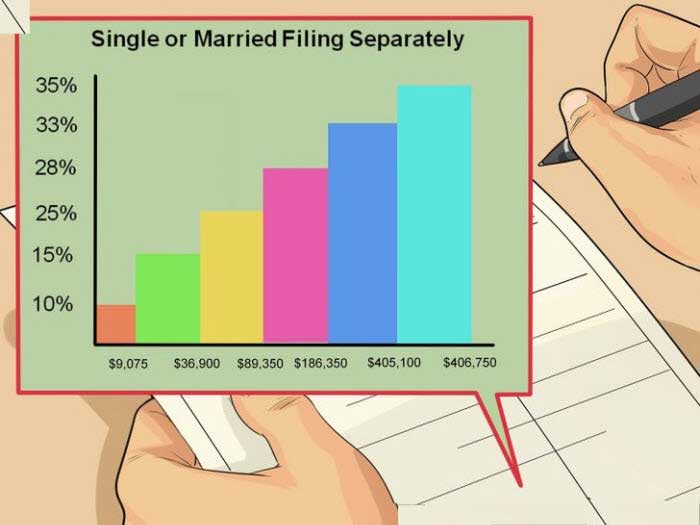

The question one may ask is what are the tax brackets? A tax bracket is simply a range of income that is taxed at a given rate. Tax brackets are normally set based on income levels. In fact, they are simply known as a division at which tax rates change in a progressive tax system. There are seven income tax brackets attached to tax rates. The IRS tax brackets rates like the 2016 tax brackets are reviewed periodically and adjust them based on inflation for every tax year.

The major filing statuses consist of single filers, married filing jointly or qualifying widow or widower, married filing separately and head of household. Each of these statuses pay a tax rate corresponding to the bracket depending on specific range of incomes.

The 2016 tax brackets has been adjusted to take into account the inflation adjustments. Single tax payer earning more than $415,050 will now use the tax rate of 39.6%. The 2016 tax bracket is shown in the table below.

Tax Brackets for 2016

| Tax Rate | Single Filers | Married Filing Jointly or Qualifying Widow/Widower | Married Filing Separately | Head of Household |

|---|---|---|---|---|

| 10% | Up to $9,275 | Up to $18,550 | Up to $9,275 | Up to $13,250 |

| 15% | $9,276 to $37,650 | $18,551 to $75,300 | $9,276 to $37,650 | $13,251 to $50,400 |

| 25% | $37,651 to $91,150 | $75,301 to $151,900 | $37,651 to $75,950 | $50,401 to $130,150 |

| 28% | $91,151 to $190,150 | $151,901 to $231,450 | $75,951 to $115,725 | $130,151 to $210,800 |

| 33% | $190,151 to $413,350 | $231,451 to $413,350 | $115,726 to $206,675 | $210,801 to $413,350 |

| 35% | $413,351 to $415,050 | $413,351 to $466,950 | $206,676 to $233,475 | $413,351 to $441,000 |

| 39.6% | $415,051 or more | $466,951 or more | $233,476 or more | $441,001 or more |

Tax Brackets for 2015

| Tax Rate | Single Filers | Married Filing Jointly or Qualifying Widow/Widower | Married Filing Separately | Head of Household |

|---|---|---|---|---|

| 10% | Up to $9,225 | Up to $18,450 | Up to $9,225 | Up to $13,150 |

| 15% | $9,226 to $37,450 | $18,451 to $74,900 | $9,226 to $37,450 | $13,151 to $50,200 |

| 25% | $37,451 to $90,750 | $74,901 to $151,200 | $37,451 to $75,600 | $50,201 to $129,600 |

| 28% | $90,751 to $189,300 | $151,201 to $230,450 | $75,601 to $115,225 | $129,601 to $209,850 |

| 33% | $189,301 to $411,500 | $230,451 to $411,500 | $115,226 to $205,750 | $209,851 to $411,500 |

| 35% | $411,501 to $413,200 | $411,501 to $464,850 | $205,751 to $232,425 | $411,501 to $439,000 |

| 39.6% | $413,201 or more | $464,851 or more | $232,426 or more | $439,001 or more |

The question is what is an effective tax rate? The answer to this question can be directed to both individual and corporation. However, for an individual, an effective tax rate is the average rate in which your earned income is taxed. It is calculated as the total tax paid divided by the taxable income. The effective rate is a good method to determine how much tax should be paid when compared to what is being earned because it is sometime difficult to determine the amount of income being taxed.

The following steps are involved in estimating the effective rate :

Step 1: The first thing to do is to estimate the pretax income. Here, you have to count everything in which report is made on for taxation. An example of this is wages, rents received, capital gains recognized, and taxable as well as non taxable interest. You are also expected to include employer’s contribution like the employment contributions and tax to retirement plans. It is to your advantage to ask for a complete breakdown of all personal taxes and benefits paid by the employer.

Step 2: Secondly, it is important to determine the income that has been earned from other sources. For example, it could include subsidies of the government.

Step 3:Then estimate all your income as the sum of all your pre tax cash income as well as all other income from other sources.

Step 4:The amount paid as taxes should now be calculated. This amount will show how much money you have owed in income taxes for the year.

Step 5:Finally, divide the taxes paid by the earned income and multiply by 100 to convert and obtain in terms of percentage the income you paid in federal taxes.

Still get confused or have more suggestions? Leave your thoughts to Community Center and we will reply within 24 hours.